Domestic Natural Gas Liquids (NGLs) production is projected to increase by more than 45% by 2040. What are the resulting opportunities for valve actuator manufacturers?

Shale Gas in the U.S.

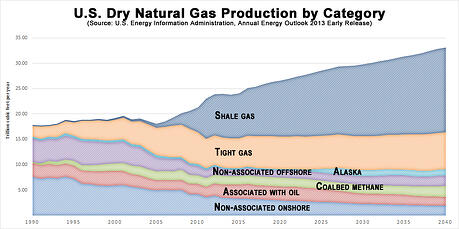

The U.S. Energy Information Administration's Annual Energy Outlook 2013 Early Release projects domestic natural gas liquids (NGLs) production to grow by 48% over the next 30 years. Most of this growth in U.S. natural gas production is due to the predicted increase in shale gas production, as can been seen in the chart below.

Granting the forecasts for shale gas production are encouraging, they remain very uncertain because of the difficulty to evaluate this new resource. Several shale formations, particularly the Marcellus (expanding from New-York State to West Virginia), are so vast that only a partial portion of the whole formation has been comprehensively production-tested. The true size, usable amount and thus economic impact is still to be determined. On the other hand, the upcoming development of well drilling and extraction technology could significantly increase site productivity and reduce extraction costs.

Granting the forecasts for shale gas production are encouraging, they remain very uncertain because of the difficulty to evaluate this new resource. Several shale formations, particularly the Marcellus (expanding from New-York State to West Virginia), are so vast that only a partial portion of the whole formation has been comprehensively production-tested. The true size, usable amount and thus economic impact is still to be determined. On the other hand, the upcoming development of well drilling and extraction technology could significantly increase site productivity and reduce extraction costs.

Opportunities for valve actuator industry

This revival of the American petrochemicals production is good for the whole U.S. economy and especially profitable for the automation industry, creating many opportunities in different parts of the energy industry: upstream, midstream and downstream.

Upstream: In 2013, the USA had more than 1,700 NGLs rigs, which is more than the rest of the world combined. Maintaining and seconding the continuous expansion of well drillings requires multiple types of valves and actuators. Gate valves are being automate with multi-turn actuators, globe valves mostly with linear actuators (short stroke) and ball valves typically with quarter-turn actuators.

Midstream: Once the NGLs is extracted, transportation is needed. New pipelines from production to refineries are a big part of the midstream opportunities. Fully-ported valves are often required for the job. Lack of air-supply along the pipeline, makes electric actuators a must-have.

Downstream: Refineries and others adjacent plants in the industry are nowadays highly automated and efficient. In the USA, we count 1 new refinery per additional million tons of NGLs refined every year. Knowing that this kind of plant can cost several billions of dollars, the budget for the valve automation package is quite important and can be ranging anywhere from $10 to 50-million. New refineries are not the only opportunities. Indeed, despite being less mediatized, upgrading and expanding existing plants is also a tremendous market segment for valve actuator manufacturers. All kind of actuators are being used downstream: pneumatic and electric powered rotary, both quarter-turn and multi-turn, and linear motion.